There are many different ways you can give to The Theatre of Western Springs Foundation. Below are several suggestions on ways to give with instructions on how that may be accomplished.

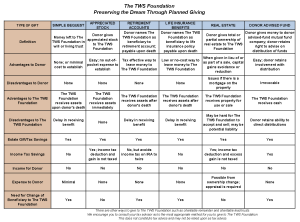

The chart in the image shows in detail the many different ways to give to The TWS Foundation. You can also find it in the TWS Foundation brochure.

Download the TWS Foundation brochure (PDF): Preserving the Dream

Simple Bequest

A gift can be made following your death, by including a simple sentence or two in either your Last Will and Testament or your living trust. The gift can be expressed as a percentage or in a simple dollar format, as follows:

I give, devise, and bequeath the sum of $__________ to The TWS Foundation, Inc., 4384 Hampton Avenue, Western Springs, Illinois 60558 (FEIN #20-5693587).

Gifts of Life Insurance

A gift can be made, following your death, by changing the beneficiary designed in an existing life insurance policy that you may own today. It is important to request a “Change of Beneficiary” form from your life insurance company or one of its agents. The change will only be effective if the form is sent to the insurance company and the change is made in their corporate records.

Frequently, these forms can be found on the Insurance Carrier’s Website. The primary beneficiary listed on an annuity or life insurance policy can be one or more persons or organizations. The gift can be expressed as simple dollar amount or as a percentage of the policy proceeds, as follows:

___% to The TWS Foundation, Inc., 4384 Hampton Avenue, Western Springs, Illinois 60558 (FEIN #20-5693587)

Gifts from Retirement Plans

Lifetime gifts can be made directly from your retirement plan to The TWS Foundation. Pre-tax dollars can pass income tax-free to charity. Over the last several years, the income tax laws have permitted individuals over 70 ½ years of age to direct the Trustee of their retirement plans to pay some or all of their Required Minimum Distribution (RMD) directly to charitable organizations such as The TWS Foundation. Please check with your income tax advisor in order to determine if this income tax benefit is available under today’s tax law before contacting the retirement plan trustee.

Gifts can made following your death from retirement plan assets, by changing the beneficiary designated in the plan today. The pre-tax dollars will pass free of income tax and free of estate tax to the foundation. It is important to request a “Change of Beneficiary” form directly from the trustee of your retirement plan. The change will only be effective, if the completed form is returned to the trustee and the change is made in their business records.

Frequently, these beneficiary change forms can be found on the Trustee’s Website. The primary beneficiary listed on retirement account can be one or more persons or organizations. The gift can be expressed as simple dollar amount or as a percentage of the account, as follows:

___% to The TWS Foundation, Inc., 4384 Hampton Avenue, Western Springs, Illinois 60558 (FEIN #20-5693587)

Gifts of Appreciated Securities, Real Estate or Cash

Donate Now (on the Donate Page, please select The Theater of Western Springs Foundation)

Lifetime gifts can be made in either cash (i.e., via check), or by transferring appreciated securities (i.e., stocks and bonds), or by transferring the title to real estate to The TWS Foundation. The TWS Foundation is a public charity. As a result, the Fair Market Value of appreciated securities and real estate may be claimed as a charitable contribution deduction on your personal income tax return. If you transfer the property, before it is sold, you can avoid the transfer costs (sales commissions) and any capital gains taxes. The TWS Foundation can sell the assets from any income taxes. So it is a Win-Win for both you and The TWS Foundation.

Publicly traded securities can be transferred directly The TWS Foundation existing account at Charles Schwab. Please contact one of the Trustees of The TWS Foundation for specific instructions and assistance in making transfers of appreciated securities.

Gifts of real estate can be problematic for both you and The TWS Foundation. Appraisals, existing liens and mortgages, hazards, and environmental concerns may need to be reviewed and resolved before any gift can be completed. Please contact one of the Trustees of The TWS Foundation for specific instructions and assistance before making any transfers of real estate.